Who could have thought that one day we would be able to complete a purchase just by talking to a smart speaker like Alexa? A few decades ago, we were a bit skeptical about shopping online. Let’s admit it. We didn’t know how safe it was to proceed with a digital purchase. Following the same line, some of us must have experienced the same while making our first contactless payment.

Nowadays, not only are we at ease with doing everything digitally. But we now can choose among multiple payment options. It’s fast and efficient the way it is!

Considering how we pay for our orders now, what should we expect for 2021? In this article, we’ll point out the digital payment trends for the current year.

What Are the Pandemic Impacts on Digital Payment Trends for 2021?

Due to the COVID-19 outbreak, most businesses did not have a choice but to make some adaptations. Contactless payment, for instance, is “COVID-save,” as there is no need to type in your pin code or even touch the POS terminal. Physical stores without this option must rush for having contactless payment when they are allowed to open their doors again!

As a consequence of having the doors to the physical stores closed, people turned to online services. It was a call for improvement in every aspect of doing business online. It is essential to have a functional and responsive website. After all, User Experience is important more than ever before. However, a beautiful website is nothing without performing customer service.

Preparing your customer support team is vital to follow the digital payment trends for this year. Some people may not be familiar with certain options to pay, and a prepared agent can quickly help.

Moreover, as the restrictions slightly loosen, businesses must focus on cross-channel experiences, like click and collect. It is a way to expand the purchase journey by giving customers the possibility to pay online and just pass by later to pick their orders.

Paysafe’s report from 2020 pointed out that 38% of consumers planned on shopping online more, even when the pandemic is no longer a factor in their lives. The percentage tends to rise still, and for this reason, businesses should definitely invest in alternative digital payments.

4 Digital Payment Trends Not to Be Missed

Conversational Payments

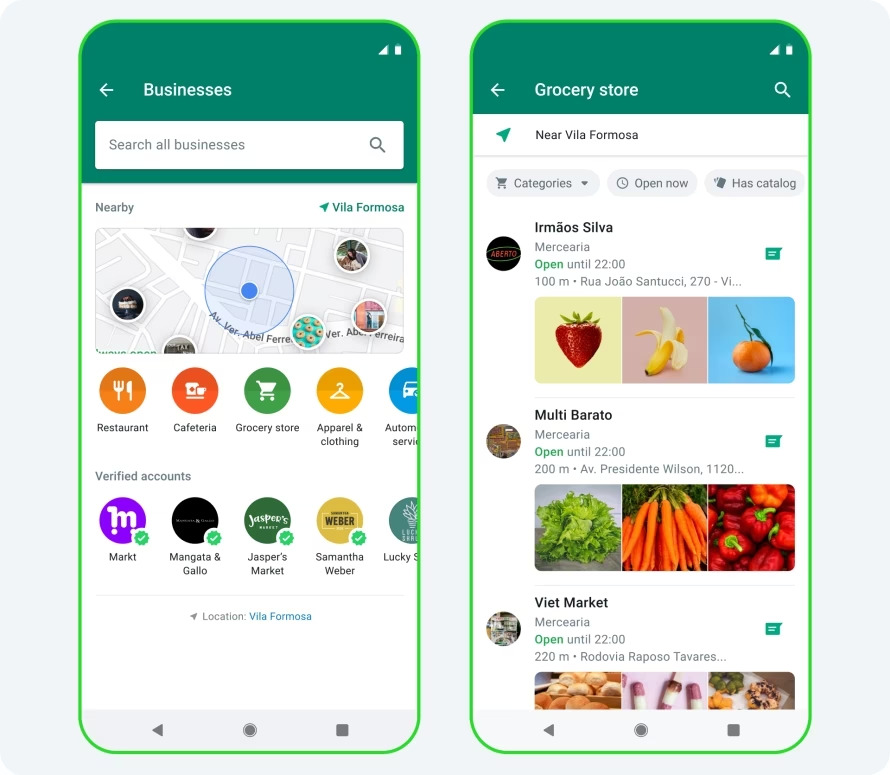

Within live chat and messaging apps like WhatsApp and Facebook Messenger, consumers can get support and ask questions. And now they also have the possibility to place an order during the conversation.

Suppose a consumer is not sure about the size to choose for trousers. An agent can quickly help them find the perfect size and even suggest they get two sizes and return the one that doesn’t fit for free.

If the consumer then decides to buy the article, the agent can send them a payment link. With conversational payment, it is simple all the way through. Consumers can place their orders without leaving the app.

Moreover, conversational payments make room for up-selling. Taking the example of the consumer that asked about the sizes again, the agent can also suggest a t-shirt that goes well with the trousers they picked.

It is a digital payment trend to keep an eye on, as customers seek efficiency through their purchase journey. By providing such a convenient service like this one, businesses can top customers’ expectations and be sure to increase customer satisfaction.

Biometric Authentication

Among the digital payment trends for this year, we can highlight the one that should have the most substantial impact. Due to the rise in fraud and identity theft, biometric authentication can be a reliable and safe part of the purchase journey.

Biometric authentication works by comparing biometric data capture to the one stored and confirmed authentic data in the database. We can mention voice identification and facial recognition as some of the examples of biometric authentication.

The Rise of Buy Now, Pay Later

With consumers spending more time online, conversational commerce escalated fastly. Conversational commerce is about how businesses communicate with their customers using messaging apps to drive sales. Whether it is on live chat, WhatsApp, or Facebook Messenger, customers can easily place an order without leaving the app.

Customers love the ease and convenience of purchasing within the chat, and in the same manner, they also appreciate the possibility to Buy Now and Pay Later. With no surprise, we can mention the fact that nearly 10 million British people avoided retailers that do not offer BNPL options.

Businesses might consider this option for 2021. Besides getting popular as a tool to increase customer loyalty, it helps boost basket conversions. By having BNPL options, you may notice a decrease in cart abandonment.

Digital Wallets

Digital wallets have become a trend in recent years. With this digital payment method, there is no need to carry one or more debit or credit cards around. By using near-field communications technology, an e-wallet allows the user to complete purchases easily and quickly.

E-wallets simplify the payment process and store information securely. Besides, they offer other benefits such as cashback and transfer fee waivers. Another good thing about this payment method is that it is no longer restricted to smartphones but can also be used with e-watches.

PSD2 – Payment Services Directive

We are careful and want to be sure that there won’t be payment frauds on our services. Considering that, the Revised Payment Services Directive keeps regulating payment services through the European Union.

Businesses have until September 2021 to update their security requirements according to PSD2 directives. It is an occasion to modernize payments processes and improve customer experience!

Flexibility and ease are the watchwords for this year’s digital payment trends. 2021, by the way, is about to see significant growth in the number of eCommerce. Thus, businesses must be ready to be around their customers throughout the whole purchase journey.

More than offering multiple payment options, companies should focus on having strong customer service. Customer support agents must be ready to assist consumers that want to learn more – or need any help – about the possibilities they have to pay for their order.

Lastly, it is essential to keep an eye on each of these trends and analyze which of them can work well for your business and help you boost it. It ensures that you are looking in the right place and investing in the future of your eCommerce business.

Ready to have conversational payments as a part of your business? Click here!