PYMTS new report shows growing interest in the buy now pay later solutions. In which consumers are able to receive products. Whilst having the opportunity and flexibility to pay for it at a later date.

This report sheds some light on how the pandemic has changed payment preferences. This comes as an increasing number of people turn to online shopping.

Contrary to popular belief that millennials are a generation that do not possess or massively favour the use of a credit card. The report has found that nearly nine out of 10 own at least one. This generation helps to make up the largest consumer groups of today. And they also come with their own set of unique spending habits and priorities. PYMTS suggests that especially when it comes to online shopping, millennials are seeking out flexible and responsible ways. Enablin gthem to pay for items such as clothing, electronics and furniture. This spending habit has subsequently been enhanced as the current pandemic has forced more people to turn to online purchasing.

As we see the popularity of the pay later schemes begin to emerge, there is some particularly interesting findings. Although one might think this is due to many seeing this financing option as a “last resort” the reality is much different. In fact, the report tells us that BNPL users tend to have higher incomes than averag. Instead they view BNPL as an important financing tool.

As we know, millennials are a generation that value Transparency and ease which helps further explain why this solution is gaining momentum amongst this generation. With access to several payment methods and rewards, BNPL offers a secure and simple solution for those budget conscious users. Furthermore, the PYMTS study has also revealed that 39% of millennials who haven’t tried the payment solution said they would be interested in doing so through digital wallets, highlighting the huge potential it has to see further growth in popularity in the coming future.

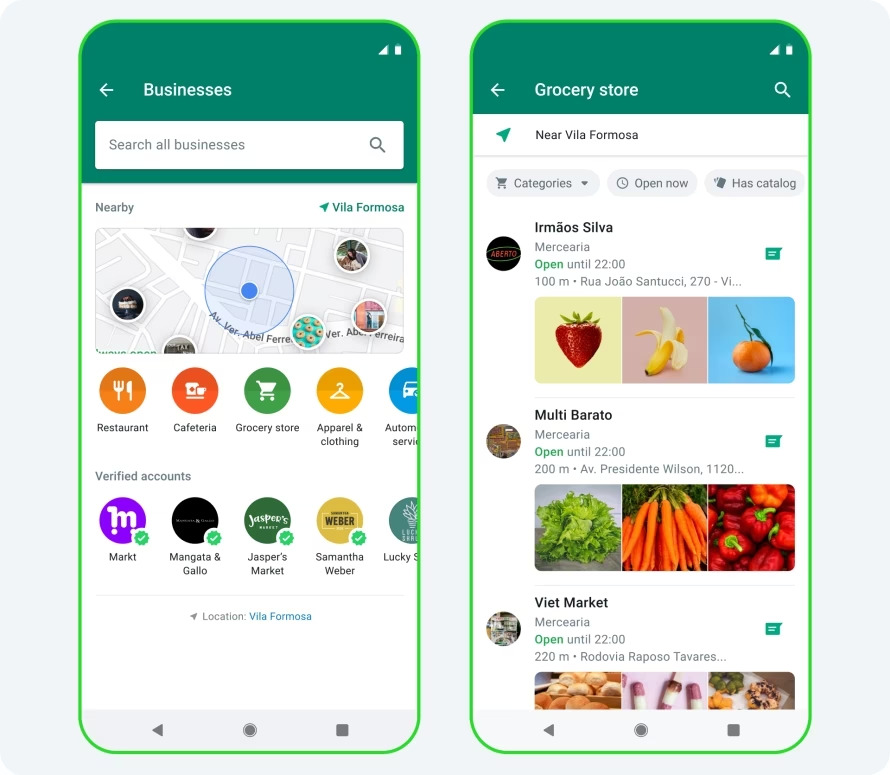

Payment Through Conversation

A welcome little addition to the new payment methods or solutions we are seeing emerge is that of the mobile phones ability to not only provide a means of communication but additionally payment through conversation. Increasingly, this form of payment is becoming more popular due to its ease and convenience. It also provides for business an overall omnichannel experience for customers who do not have to leave a single platform to complete a journey. That means that customers who want to opt for a buy now pay later plan, when they wish to complete their transaction or have any questions concerning the matter can do both at the same time on the channel of their choosing.

To discover all findings of the PYMTS study you can download the report here!